RJ45 Connectors

RJ45 modular telephone jacks are small components but can provide high-powered performance for applications such as data, voice and fast-speed networking.

We provide a comprehensive range of standard and custom jacks to cater for various industries.

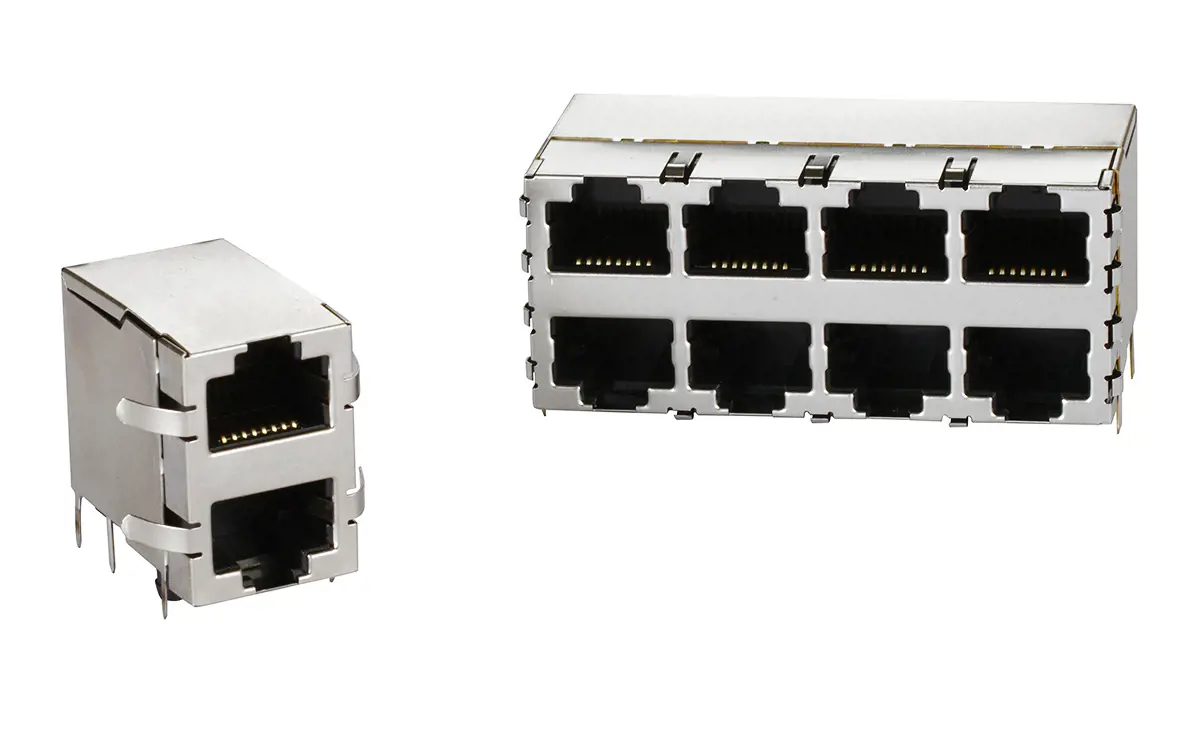

Our jacks are available in both single and multiple gang styles and all are built to conform to FCC testing requirements.

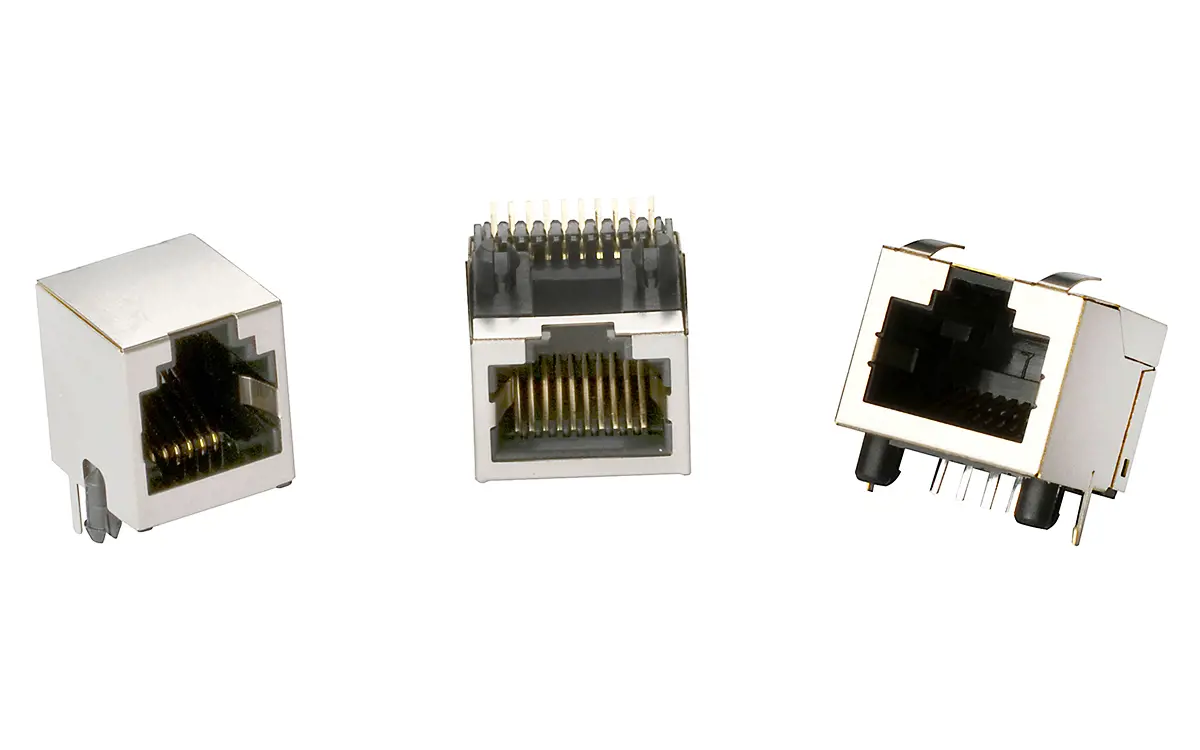

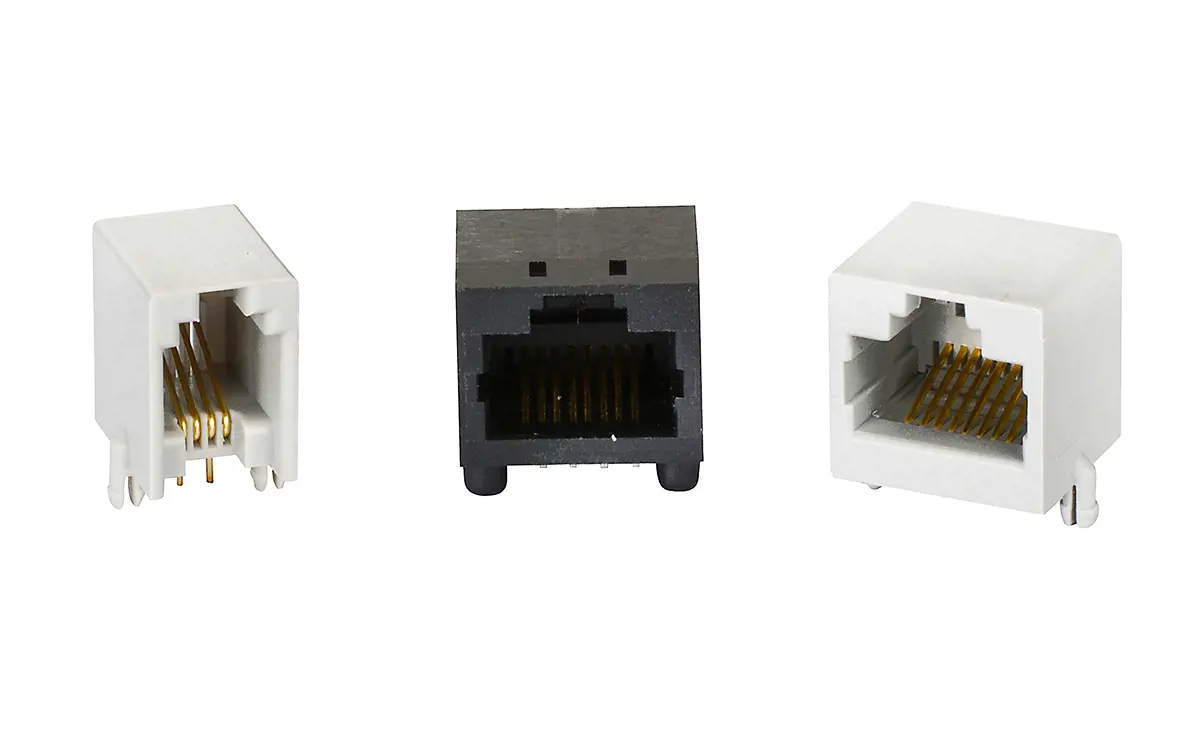

- Range of sizes including RJ10, RJ11, RJ12, RJ45 and RJ50

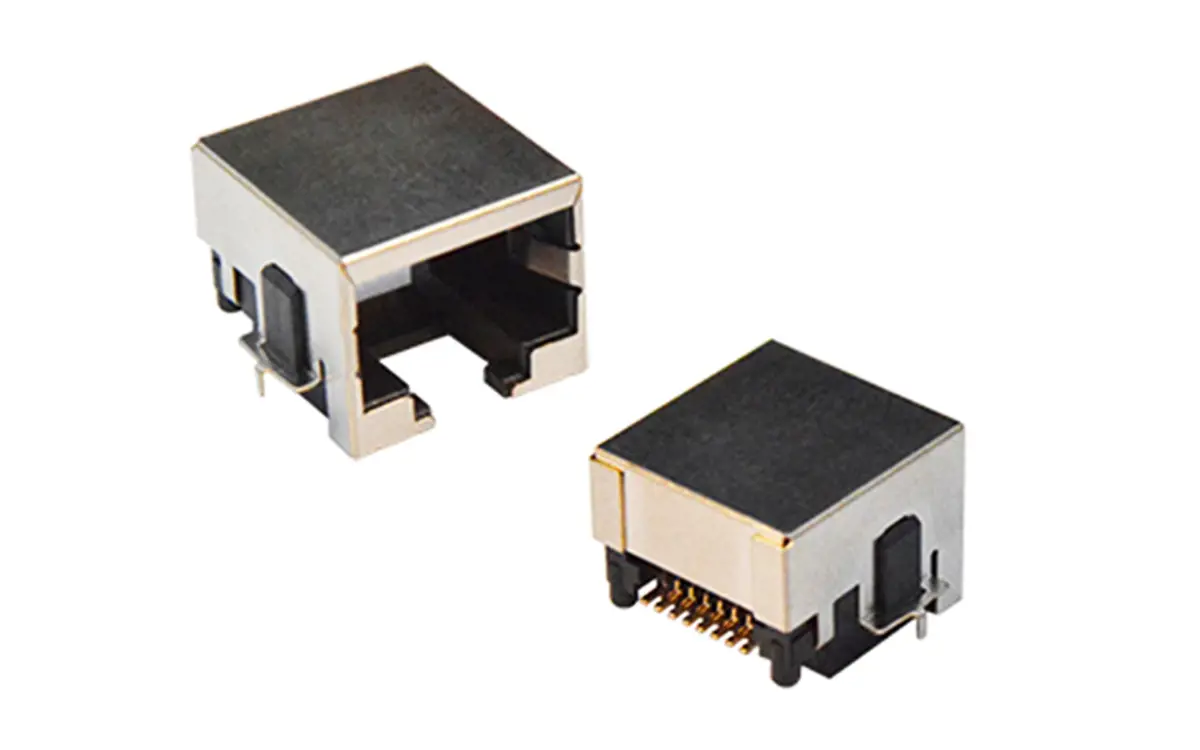

- Shielded and unshielded options

- Single-port, multi-port and harmonica layouts

- Available with LEDs in custom configurations

- Magnetic jacks for 10/100Base-T and Gigabit speeds

- Stacked RJ45 / USB connectors